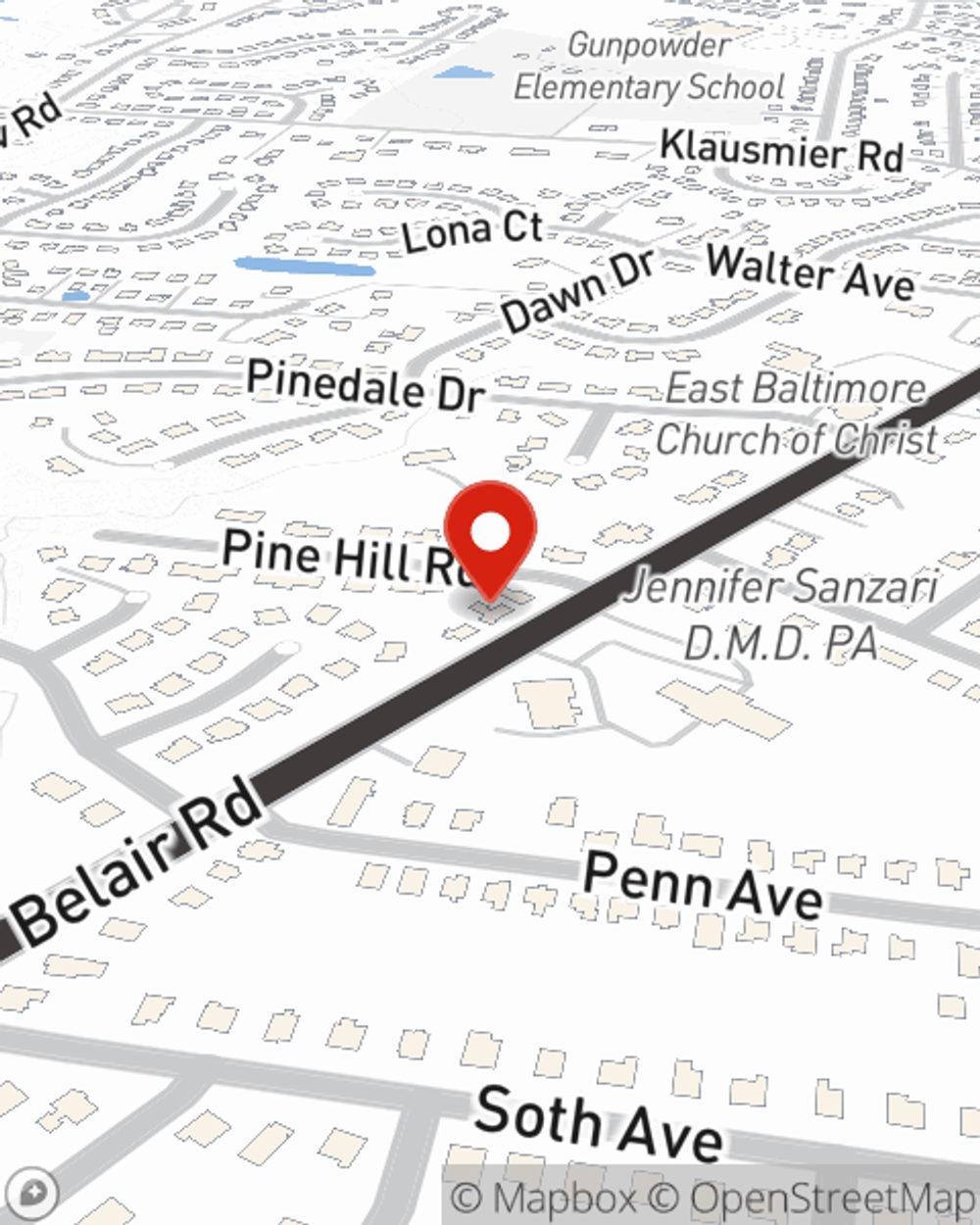

Business Insurance in and around Baltimore

Get your Baltimore business covered, right here!

No funny business here

- Perry Hall

- Bel Air

- Kingsville

- Nottingham

- Abingdon

- Forest Hill

- Parkville

- Jarrettsville

- Edgewood

- Middle River

- Essex

- Dundalk

- Fallston

- Baldwin

- White Marsh

- Glen Arm

- Towson

- Aberdeen

- Overlea

- Rosedale

State Farm Understands Small Businesses.

Running a small business comes with a unique set of wins and losses. You shouldn't have to wrestle with those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including errors and omissions liability, business continuity plans and worker's compensation for your employees, among others.

Get your Baltimore business covered, right here!

No funny business here

Protect Your Future With State Farm

When you've put so much personal interest in a small business like yours, whether it's a donut shop, a toy store, or a lawn care service, having the right coverage for you is important. As a business owner, as well, State Farm agent Tom Benisch Jr understands and is happy to offer personalized insurance options to fit your business.

Get right down to business by calling or emailing agent Tom Benisch Jr's team to explore your options.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Tom Benisch Jr

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.